Table of Content

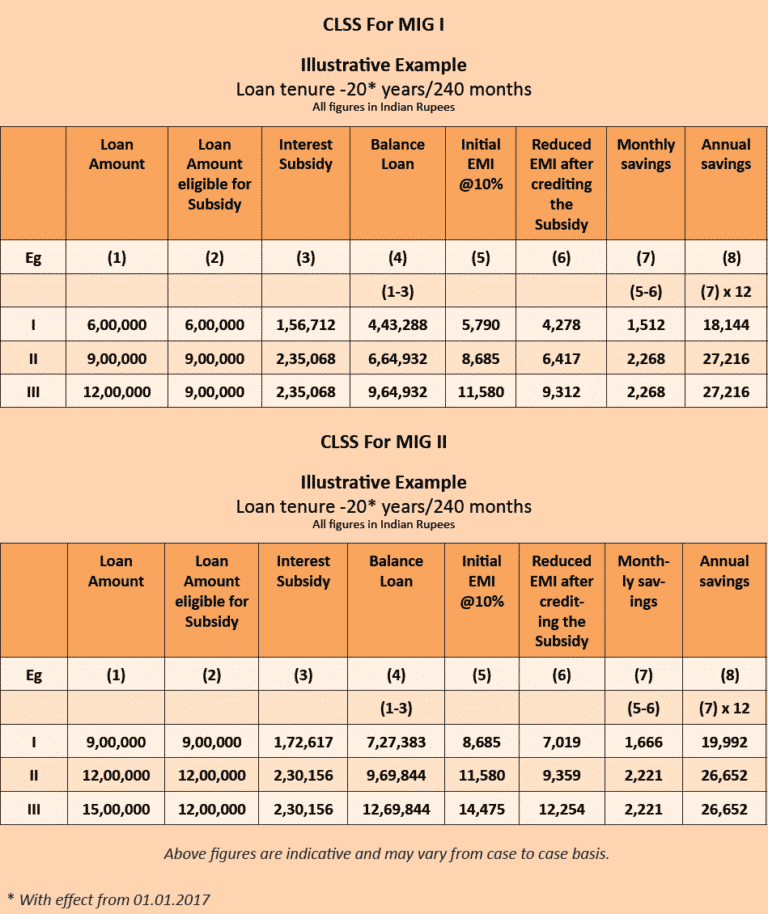

Just drag the intuitive slider to see different scenarios instantly. Fincity’s online EMI calculator tells you the different EMI possibilities (i.e. Different possible monthly installments) you’ll have to pay depending on different loan amounts and tenures. Some people want to find the best match between the monthly payment amount and the number of months they’ll have this burden. EMI is how much you’ll pay monthly to eventually clear off your loan.

Even though your monthly EMI payment won't change, the proportion of principal and interest components will change with time. With each successive payment, you'll pay more towards the principal and less in interest. Your loan program can affect your interest rate and total monthly payments.

Partial Prepayments — Amount and Start Date

The best and free Home Loan EMI Calculator to calculate your Home Loan EMI online. With our easy to use calculator, you will be able to calculate your Home Loan EMI hassle-free. You just need to enter your Loan Amount, Loan Tenure, Rate of Interest, and hit “Calculate EMI“. Your detailed EMI Calculation with the Amortization Schedule and Payment breakup of your Home Loan EMI is ready for you completely free. The difference between home value and the mortgage amount is considered your down payment.

Compare that with Duval County, home of the largest city, Jacksonville, at only $180,700. If you take the Florida housing market as a whole, youll see that the state is recovering from the recession, which led to many foreclosed homes. The state also ranks in the bottom half of SmartAssets Healthiest Housing Markets study, which looks at stability, affordability, fluidity and risk of loss factors. These costs aren’t addressed by the calculator, but they are still important to keep in mind. Also, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. These ads are based on your specific account relationships with us.

Which is better, Fixed rate home loan or Floating rate home loan?

You should consider all these factors, especially when making a rent vs. buy decision. It has become common these days to purchase high-end electronic gadgets, furniture and household appliances (such as fridge, TV, washing machine etc.) using installment loans. Manufacturers and sellers lure buyers with low EMI payments and buyers fall into the trap without understanding the interest rate for such loans. Given the loan amount (i.e., item price), EMI and tenure, this calculator helps you estimate the interest rate on such loans.

You just need to know the total mortgage loan amount you are looking for, the rate of interest on which you are availing your loan, & the loan term. The loan amount slider increases or decreases the amount in 1 lac variable. Once you select the desired loan amount, interest rate, down payment, and loan term, click on the “Calculate” button. Your initial EMIs will be more interest-heavy, and you will pay off a large part of the interest component here. Principal repayments in the due course of your repayment schedule will reduce your interest liability as well.

How to Use EMI Calculator?

Subsequently, the repayment is accelerated proportionately with the assumed increase in your income. Modify the interest rate to evaluate the impact of seemingly minor rate changes. Knowing that rates can change daily, consider the impact of waiting to improve your credit score in exchange for possibly qualifying for a lower interest rate. Click the "Schedule" for an interactive graph showing the estimated timeframe of paying off your interest, similar to our amortization calculator. VA mortgage calculatorUse our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families. Calculate EMI for a fixed rate loan spanned across years with annual and monthly amortization tables.

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment. It’s a monthly payment that the borrower makes towards repayment of the home loan. The best part about EMI is that you get to repay back the loan in small parts which are easier for most salaried individuals. If something is unaffordable for you as of now, you can purchase it by taking a loan and repaying back in smaller EMIs over a period of time.

Loan Insurance is the single premium amount, for the Home Loan Protection Plan OR Term Insurance Plan, that gets included in your home loan amount. If you want to guesstimate this amount, use the LIC premium calculator to calculate yearly premium for eTerm plan using your age, loan term and loan amount for Sum Assured. If you are planning to make a partial pre-payment on an existing loan, you can determine the remaining tenure on the outstanding principal amount using this calculator.

For that reason, your APR is usually higher than your interest rate. And it goes without saying that you might be excited to take home loan due to rate cuts, but its always advisable to assess other factors as well and not just depend on the loan interest rates. Also, read why taking personal loan for downpayment is not advisable. The larger your down payment, the more likely you are to qualify for lower interest rates. We recommend your down payment be at least 5% of the purchase price.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable. Want to make part prepayments to shorten your home loan schedule and reduce your total interest outgo? If you wish to calculate how much loan you can afford OR determine advertised vs actual loan interest rate on a purchase, use our loan calculator. Equated Monthly Installment - EMI for short - is the amount payable every month to the bank or any other financial institution until the loan amount is fully paid off.

EMI refers to the ‘Equated Monthly Installment’ which is the amount you will pay to us on a specific date each month till the loan is repaid in full. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property. Floating rate loan are not subject to any prepayment or pre closure charges. You can prepay your home loan by any amount during the period of loan. Similarly, you can close the home loan any time during the loan period and you don’t have to pay charges or penalty for it. It is important to note here, that fixed rate loan may be subject to prepayment or pre-closure charges depending on the bank’s term and condition.

You should take into account loan limits on conventional loans set by FHFA. Loan Fees & Charges includes Processing Fees, Administrative Charges etc. along with service taxes, entered either in Rupees or as a percentage of Loan Amount. Instant payout on selling shares, with the ICICIdirect Prime Account.

This tool finds the effective interest rate for a flat rate interest loan. He works with small investors as well as HNI clients across India. The calculator will also give you the EMI principal and interest calculator breakup in excel. Many people think that EMI calculations are tough and even if they tried, they won’t be able to figure things out.

No comments:

Post a Comment