Combining this lender know-how with given information and projected information , we evaluate a range of scenarios and outcomes to see how you will fare under different conditions. We discuss the outcomes and logic of the recommendations with you. You are different from the average customer, sometimes a little and sometimes a lot. Our engine combines modern finance theory with practical insights from our team of mortgage brokers. TD Bank NA may utilize third-party providers during the servicing of your loan. Please contact TD Bank NA if you have any questions.

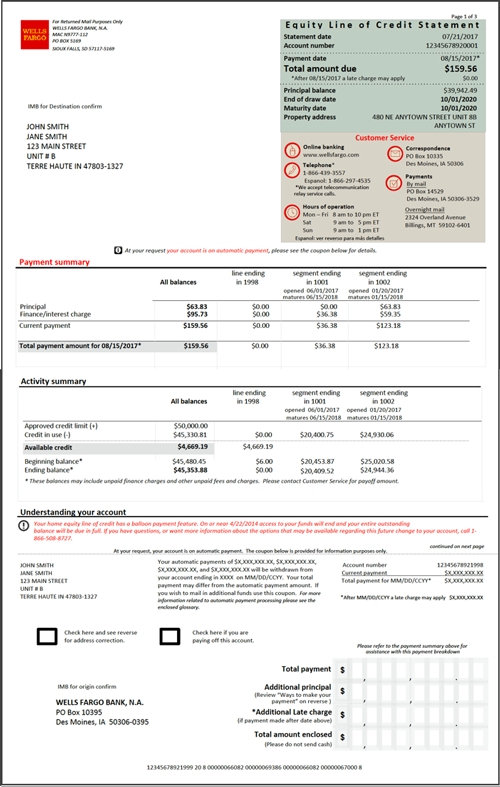

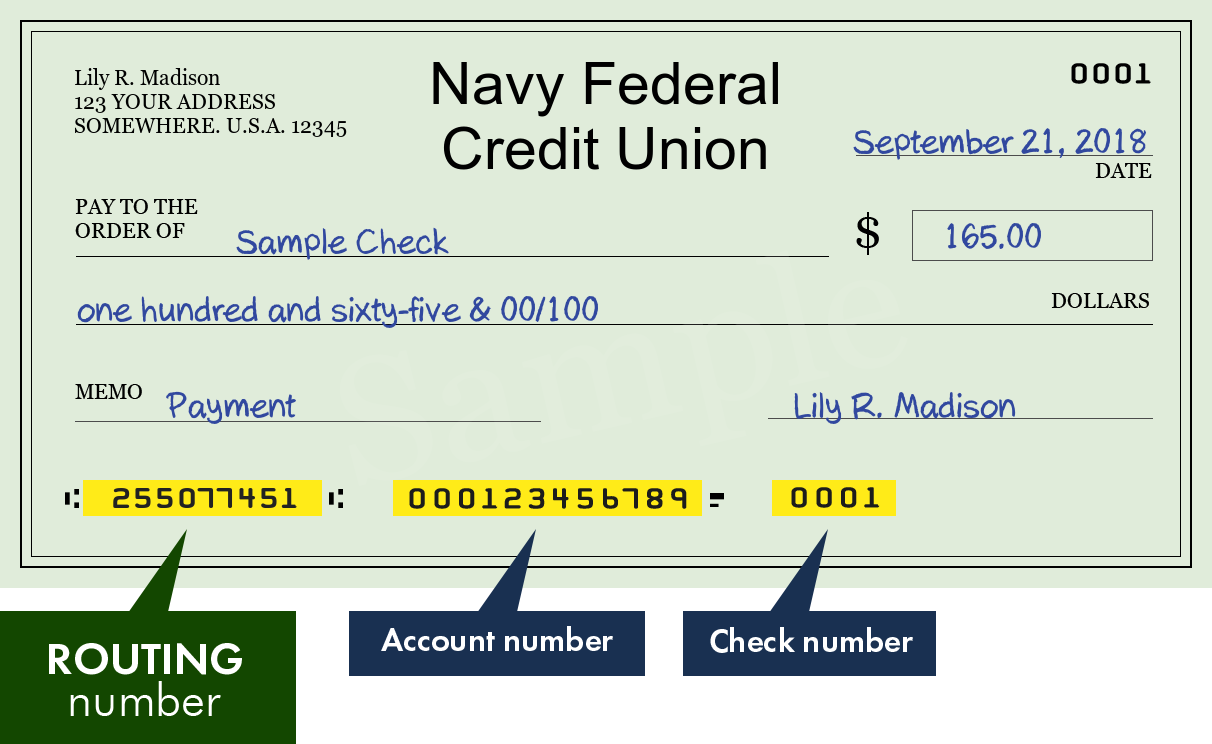

The results of the mortgage calculator give you a first impression of your mortgage possibilities and help you to get orientated. It is a sample calculation that shows an overview of your expected costs. However, our calculator does not replace a personal consultation. Learn more about finding details and payment options of your loan.

Consult for free with an advisor to understand your options

Get the full story from fellow consumers’ unbiased TD Auto Finance reviews. Explore financing options and find the best home loan for your life and budget. Hypofriend GmbHis an independent mortgage broker certified with the §34i GewO supervised by BaFin. Hypofriend works together with over 750 partner banks to find customers the optimal mortgage. Banks in Germany like safety and are interested in you paying back the mortgage. That is why banks in Germany are so strict about approving a mortgage.

If you’re a homeowner with an adjustable rate mortgage , you'll want to understand what the LIBOR transition means for you. Together with our team of experienced brokers, you will understand the nuances of your situation and fine-tune your mortgage decision. Refinance your existing home in Germany to lower interest rates or cash out on your home equity. Search job openings, see if they fit – company salaries, reviews, and more posted by TD employees. A no-fee installment loan for a one-time purchase with participating retailers.

TD Bank

The amount of equity required cannot be answered in general terms. The more equity or savings you bring in, the lower your loan-to-value ratio LTV and hence the interest rate at which the bank grants you your mortgage. Typically, banks lower the interest rate gradually in 5% steps of the LTV. In other words, a higher down payment means a lower LTV and a lower interest rate, and vice versa, a lower down payment means a higher interest rate due to a higher LTV. A fixation period which is too short could cause you financial hardship if interest rates go up significantly in the future.

However, it is possible to take out a separate personal loan for this purpose. Furthermore, your monthly repayment should be calculated realistically, so you can easily cover it without having to restrict your accustomed standard of living. The German mortgage calculator provides, among other things, an overview of the additional purchase costs and monthly repayments resulting from the given mortgage and the duration of financing. After entering this data into the German mortgage calculator, we calculate the estimated loan amount, interest rate, and monthly repayment rate.

Online

ICB Solutions and Mortgage Research Center receive compensation for providing marketing services to a select group of companies involved in helping consumers find, buy or refinance homes. If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request. By submitting your information you agree Mortgage Research Center can provide your information to one of these companies, who will then contact you. Mortgageloan.com will not charge, seek or accept fees of any kind from you. This German mortgage calculator is designed to help you determine the estimated amount you can get from over 750 mortgage lenders in Germany. However, German banks have different guidelines when it comes to rating the creditworthiness of applicants for a mortgage.

Our German mortgage calculator lists all additional purchase costs. As a rule, your savings must cover the additional purchase costs. Depending on the state, this is between 9% and 12% of the purchase price of the property.

Third-party sites may have different Privacy and Security policies than TD Bank US Holding Company. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. Our custom optimization engine and expert advisors will help you make the optimal decision for your personal circumstances.

TD Bank offers very competitive mortgage rates that it posts on the Mortgage home page of its web site and updates daily. Rates are listed without points, and the APR is provided as well, to make it easy to see exactly what the base rates are for borrowers with good credit. Among its services, TB Bank offers some of the best mortgage products anywhere. Among them is Mortgage Rate Security, which allows borrowers to obtain a lower interest rate on their mortgage without going through refinancing.

We compare the best mortgage rates in Germany for the top 750 lenders. In your secure online account, you can easily upload your required personal, property and mortgage documents to get approved faster than traditional brokers. TD Auto Finance reviews, contact info, rates & FAQ.

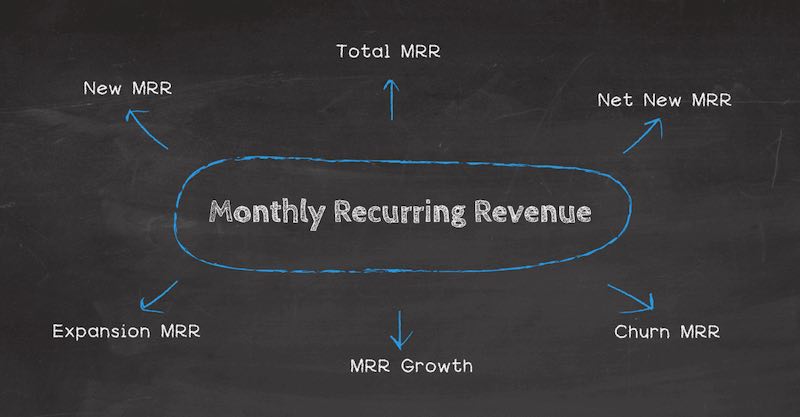

To optimize the recommendation engine, we review daily the mortgage products and conditions of over 750 lenders. We then model and estimate their hidden conditions. This is how we can understand exactly what offers are available and what conditions they have. TD Bank provides a full range of banking, insurance and wealth management services in 15 states and the District of Columbia. TD Bank is a subsidiary of the Toronto-Dominion Bank Group of Toronto, Canada, which is one of the few banks in the world rated Aaa by Moody’s.

If market mortgage rates drop, qualified borrowers can reduce their interest rate by paying a modification fee. Other terms of the mortgage, such as the payoff date, remain unchanged and closing costs are avoided. Borrowers must be current on their mortgage payments to qualify. Mortgage applications may be initiated online or at any TD Bank branch office.

Mortgageloan.com is a product of ICB Solutions, a division of Neighbors Bank. ICB Solutions partners with a private company, Mortgage Research Center, LLC, (nmls # 1907), that provides mortgage information and connects homebuyers with lenders. Neither Mortgageloan.com, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with any government agency.

For example, a homeowner who currently has a mortgage with another lender may opt to refinance with TD Bank if they find they can get a better deal there. A customer with a TD Bank mortgage may opt to refinance if they wish to shorten the term of their loan to pay it off faster, or extend it if they wish to reduce their monthly mortgage payments. TD Bank online offers a refinance calculator to determine if refinancing makes good financial sense. This helps homeowners determine if the savings from a reduced interest rate will offset the closing costs involved in refinancing. TD Bank offers three home equity loan programs, with very attractive interest rates for qualified borrowers. These loans can be good choices for such purposes as making home improvements, paying educational expenses or consolidating high-interest credit card debt.

But you take a risk as a higher loan balance remains at the end of the fixed interest rate and you may have to take out significantly higher refinancing for it. The monthly repayment rate comes from the loan amount, the annual interest rate, and the annual repayment rate. Particularly long fixed interest rates are usually higher.

No comments:

Post a Comment